Traditional ira rate of return

Compare Open an Account Online Today. Orion FCU 12 Month IRA Traditional CESA Roth 32 Reviews 225 MIN TO EARN 500 MAX -EST.

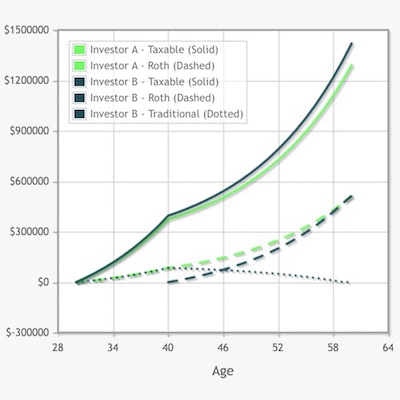

What S Best Traditional Ira Vs Roth Ira Familywealth

In 2022 this is 20500 towards a 401 k and 6000 7000 if older than 50 towards a traditional IRA.

. Ad Find The IRA Option Thats Right For You And Save With Tax Benefits. Investment return taxes employment and marital status. At the start of your retirement a Roth 401 k would have 31340 more in after-tax retirement savings than a Traditional 401 k plan.

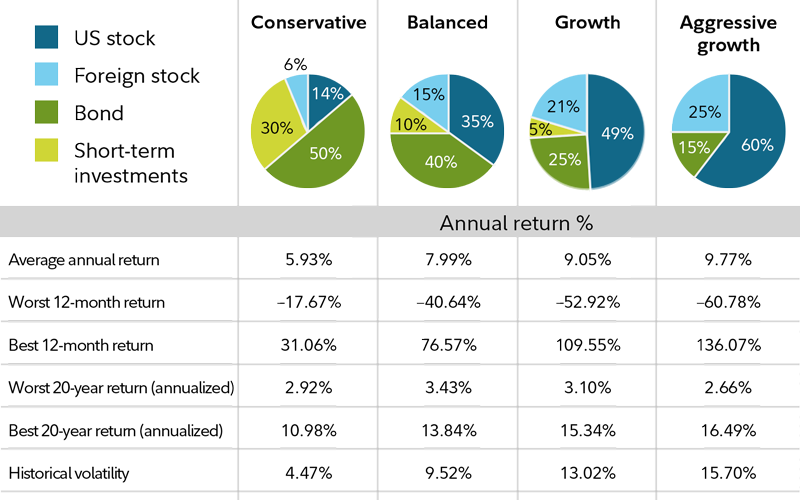

Thus the overall return of the portfolio is 326 163 5000. Help Maximize Your Retirement Savings With Solutions From Merrill. Vanguard and Morningstar Inc as of December 31 2021.

Traditional IRA calculator Choosing between a Roth vs. Ad Refine Your Retirement Strategy with Innovative Tools and Calculators. It assume a monthly contribution of 100 and a 6 average annual total return compounded monthly.

Roll Over Into A TIAA IRA Get A Clearer View of Your Financial Picture. View the Savings Accounts That Have the Highest Interest Rates in 2022. This is only true for people within a certain income range as those who have.

In the past 10 years its averaged a return of about 146. Roth 401 k 208932. Since the index was founded in 1957 its average annual return has been 1112 as of April 13 2022.

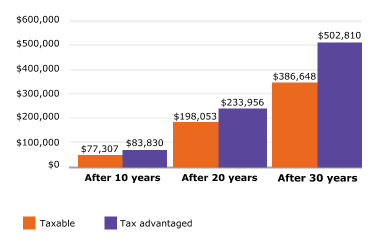

7 return 24 tax 22 tax during retirement married with an employer plan Totals At Retirement After-Tax Comparison Definitions Current age This current age of the account owner must 72. Taxable Account Definitions Starting balance The current balance of your. AARP Updated May 2022 Traditional IRA Calculator Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

Equities to return between 39 and 59 before adjusting for inflation per year over the next 10 years due to high valuations and. The returns you can expect from your IRA depends on your investment choices. Ad Discover The Traditional IRA That May Be Right For You.

Ad Grow Your Savings with the Most Competitive Rate. Opening an IRA May Help Meet Goals of Investing for Income or Growth. Take Advantage of Potential Tax Benefits When You Open a TD Ameritrade IRA Today.

Traditional IRA Calculator Charles Schwab Roth vs. Tax-deferred amounts accumulated in a. Traditional IRA depends on your income level and financial goals.

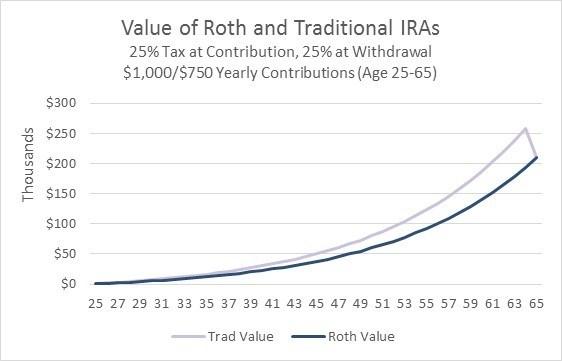

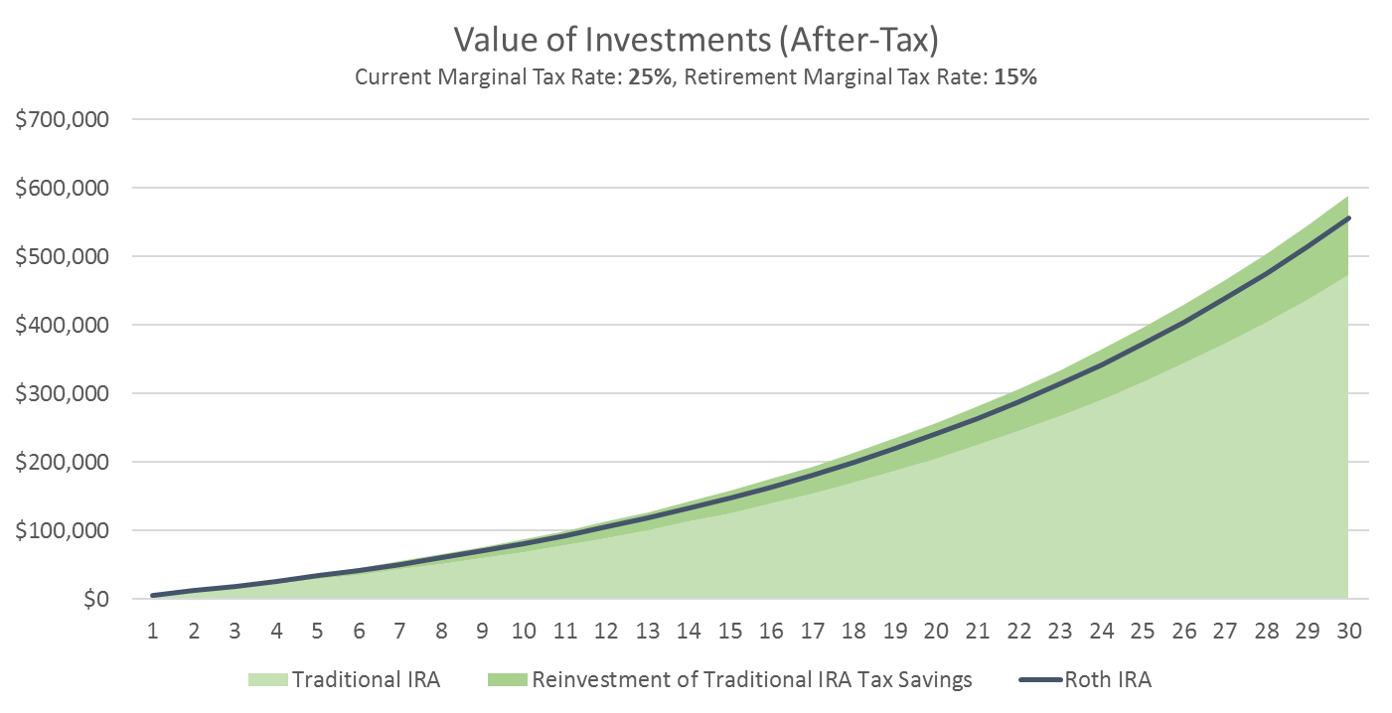

7 return 25 tax 15 tax during retirement not married no employer plan Totals at Retirement Traditional IRA vs. 7 return 25 tax 15 tax during retirement not married no employer plan Totals at Retirement Traditional IRA vs. Traditional IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

Build Your Future With a Firm that has 85 Years of Retirement Experience. When taking withdrawals from an IRA before age 59½ you may have to pay ordinary income tax plus a 10 federal. Ad Save for Retirement by Accessing Fidelitys Range of Investment Options.

This means you can claim up to 6000 or. Ad Set Your Goals and Invest Your Way With A Merrill Retirement Account. Ad Set Your Goals and Invest Your Way With A Merrill Retirement Account.

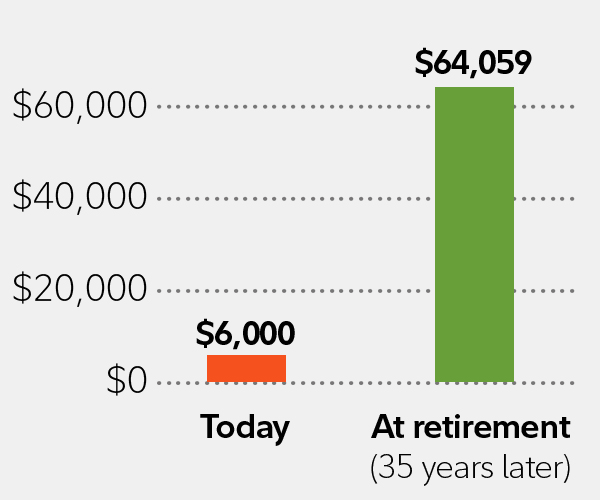

Contributions you make to a traditional IRA may be fully or partially deductible depending on your filing status and income and Generally amounts in your traditional IRA. While long term savings in a. Lets look at a hypothetical example that starts with a contribution of 6000 a year at a 24 cumulative tax rate and a 6 annual fixed rate of return.

Your investment results will be different. Traditional 401 k 177592. We chose a default average return of 9 to reflect the historical long-term.

Income tax will apply to Traditional. Deducting Your Traditional IRA Contributions on Your Tax Return Eligible contributions to a traditional IRA are tax-deductible. Help Maximize Your Retirement Savings With Solutions From Merrill.

The investment firm Vanguard expects US. Learn About Contribution Limits. EARN 562 Technology Credit Union 12 - 17 Month IRA Traditional Roth 11 Reviews.

Rate of Return.

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Vs Roth Ira Calculator

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Savings Account Vs Roth Ira What S The Difference

Roth Vs Traditional Ira Key Differences Comparison

Roth Vs Traditional Iras Seeking Alpha

/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Savings Account Vs Roth Ira What S The Difference

These Charts Show How Traditional Iras And Roth Iras Stack Up Against Each Other

Contributing To Your Ira Start Early Know Your Limits Fidelity

How To Invest Your Ira Fidelity

Who Uses Individual Retirement Accounts Tax Policy Center

Roth Vs Traditional Iras A Practical Guide Model Investing

Am I Too Old To Start An Ira Financial Stress

How To Invest Your Ira Fidelity

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Ira Information Types Of Iras Traditional And Roth Wells Fargo

When It S A Bad Deal To Inherit A Roth Ira